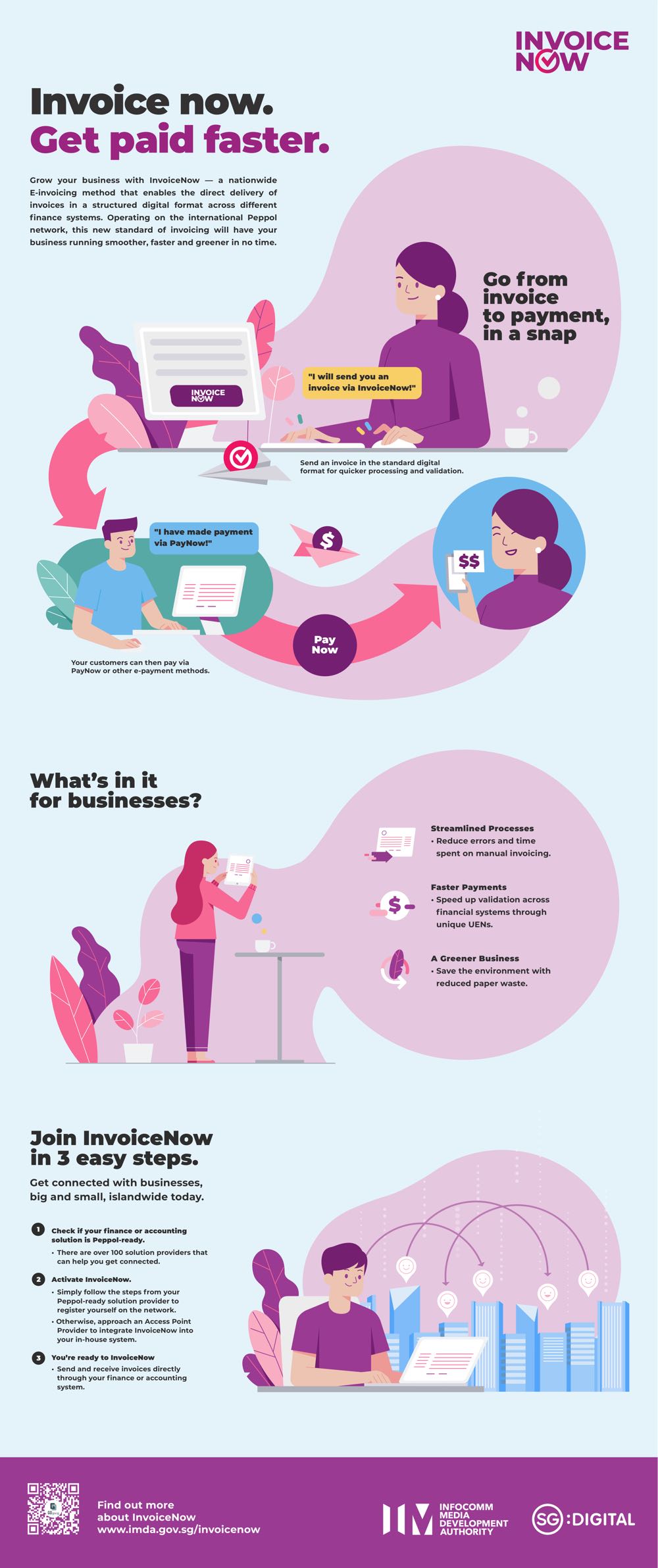

InvoiceNow (PEPPOL E-Invoicing)

Fast & Seamless Payment

InvoiceNow saves you time by simplifying and smoothing the process of sending and receiving invoices through your finance or accounting system. The ability to accept e-payments with PayNow is the main benefit for SMEs who use InvoiceNow.

Benefits

In contrast to sending a PDF file or an online invoice by email, e-invoices can be exchanged effortlessly and virtually quickly if both the sender and receiver are using InvoiceNow-ready software (such as Sage 300 Accounting System).

Even if the sending and receiving ends are using different accounting systems, InvoiceNow will still work as long as both accounting systems comply with the international Peppol standards. And many reputable and reliable accounting systems worldwide today are already on the Peppol network.

1. Automate invoicing and payments

It is tedious, inefficient and time-consuming to track invoices and payments manually. With InvoiceNow, your invoices and payments will be tracked and reconciled automatically through your accounting system. This saves time and streamlines your invoicing process.

2. Get paid faster

In Singapore, PayNow is a convenient mode of e-payment for consumers and businesses to transact digitally. InvoiceNow enables SMEs to issue invoices and accept payments sooner with PayNow. This contributes to better cashflow for SMEs.

3. Secure payments

Under the InvoiceNow system, all transactions are tied to company Unique Entity Numbers (UENs). This means that invoices and payments are sent and received securely between the parties.

4. Saves Cost

InvoiceNow distributes electronic invoices to your customers. The process is paperless, environment friendly, and provides cost savings for your business.

InvoiceNow. Get Paid Faster.

E-Invoice

Reduce errors and time spent on manual invoicing.Faster Payments

Validate e-invoices by unique UENs. Send/receive payments across financial systems.Go Green. Save Costs.

E-invoicing is paperless, eco-friendly. No printing costs.SMEs are eligible for up to 50% Productivity Solutions Grant (PSG) support for the adoption of IT Infinity Sage 300 Version IT Infinity Sage 300, a Pre-Approved Solution under the IMDA SMEs Go Digital programme.

Enquire Now

Contact us to find out more about government grants or to request for software demonstration.